There’s been quite some coverage in the recent month about TikTok on a potential ban and also a M&A transaction that might shift its ownership from ByteDance (seen as Chinese) to Microsoft (USA) within record time. This news is rather interesting for me given my previous experience looking at M&A for digital media.

I would be using this post to discuss the matter centred around a few key questions. Hopefully this would shed some light on why this is matter is interesting from various perspectives:

- What is TikTok?

- What’s so special about TikTok?

- Why the fuss?

- Could this be a really good deal for Microsoft? Or whoever the buyer might be?

- What could we expect in the coming days?

What is TikTok?

TikTok has been given the label of “Instagram for the mobile video age” by TechCrunch as is inherently a short form video app and social media platform that has gone viral in the recent two years.

ByteDance (their parent company) as a whole is drawing 1.5 Billion monthly active users to its family of apps (Douyin – Tik Tok’s Chinese twin, and Chinese news service aggregator Toutiao, and several others). Its investors include Softbank, KKR, General Atlantic and Sequoia China.

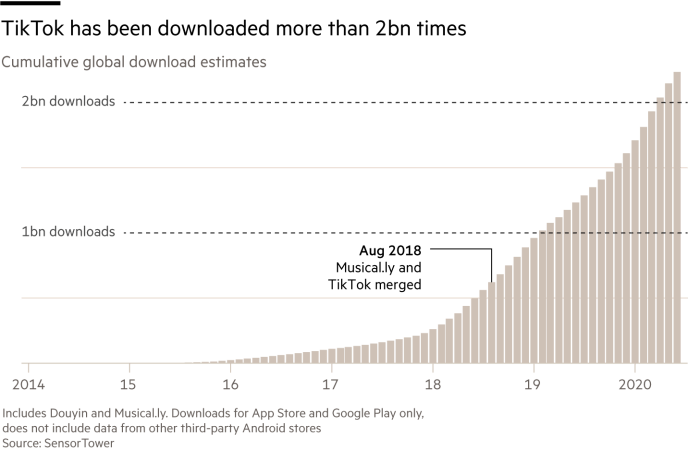

As we can see from the chart below, the covid-19 pandemic and subsequent lockdowns has actually accelerated the growth of TikTok – with downloads pushing past 2Bn in May’20 and 315Mn new downloads worldwide in Q120 according to Sensor Tower.

For more information on TikTok/ ByteDance, CB Insights offers a nice compact view through a free report over at their website.

What’s so special about TikTok?

- Chinese technology company going global | TikTok has been the most successful Chinese-origin social media company globally so far, with talks that it can potentially displaced Facebook as the leading social network

- Talent acquisition | They executed a major talent coup, hiring away Disney’s Head of Streaming, Kevin Mayer, as CEO of Tik Tok and COO of ByteDance. They are also still still in the midst of hiring even amidst the pandemic, with earlier plans of hitting 40,000 jobs in 2020 (+10,000 new jobs), which would bring them close to Alibaba’s

- Valuation | They have been the most valuable private startup since Oct’18, valued at $75Bn vs Uber’s $72Bn. ByteDance has been recently (through secondary transactions in May’20) valued at between $105Bn to $140Bn (Bloomberg), with TikTok valued at about $50Bn (Reuters). To put this in perspective, this is more than Twitter ($30Bn), Snap ($32B) but still behind Facebook ($744Bn)

- Built differently from other social networks| TikTok’s user experience is primarily driven by algorithms (curation and incentives) that enhances discovery, instead of the existing social networks or people that they might choose to follow. This leads to personalised content based on last watched videos, and recommendation to create content through its mix of viral hastags, challenges and memes. All these lead up to a sticky and addictive user experience and strong engagement metrics compared to other social media platforms (CB Insights)

- Future monetisation potential (of ByteDance as a whole) | This are still seen as early in executing their monetisation strategy in the form of advertising and in-app purchases and with further potential in music, gaming and e-commerce (through live streaming). There is good reason to believe they would be able to succeed given the advantages they could capitalise on, such as (i) their young and engaged user base, (ii) success in developing and managing their products (for viral), and their (iii) personalisation and recommendation algorithms (CB Insights)

Why the fuss?

Trump’s intervention has brought various concerns to the surface about user data privacy and security concerns if the data can be access and used by the Chinese government. He has since issued executive orders that could potentially ban TikTok from operating in the US within the next few months, pushing for a potential sale and change of ownership to a US buyer.

This has follows what had happened in end-June, the Indian government had banned TikTok as part of a blacklist of 59 Chinese mobile apps they had deemed a threat to national security. Up to then, India had been its biggest market with >650Mn downloads according to Sensor Tower.

Could this be a really good deal for Microsoft? Or whoever the buyer might be?

Currently Microsoft seems to be the most viable acquirer, given

- its current size and strong financial position, which would allow it to make this acquisition on its own

- its good experience in running operations in China since the late 90s through research labs, and positive connections and working relationships with the Chinese tech ecosystem and Chinese authorities

- the potential to get into a consumer-centric social media business (asides from LinkedIn) for younger users, which could plug into its other ecosystems such as XBox gaming into

However that being said it would likely not be a straightforward acquisition as it might pull Microsoft right into the complexity of these political tensions. Bill Gates called for caution regarding this deal, calling it “a poison[ed] chalice“, which pretty much sums up his view. Microsoft would also have to immediately step up as a big player in the social media business and to content with content moderation and also gain enough assurances that the Chinese government would not embark on retaliatory measures post transaction.

Other potential options could be Twitter, but it does not have sufficient funding on its own. And a buyout led by current investors General Atlantic and Sequoia, with ByteDance holding a minority stake. But it is not clear if such an arrangement would be deemed acceptable by the US Treasury and the Committee of Foreign Investment in the US (CFIUS).

While all this is going on, other competitors are moving ahead to take TikTok on head on in terms of operational strategies, particularly in poaching of key content creators through various forms of compensation. This includes Facebook for Instagram Reels and Triller (a smaller competitor). TikTok has responded quickly by announcing a $200Mn creator fund to supplement the earnings of their US creators.

The ultimate value depends on the “deal package” | The deal would need to comprise of the technology, data and user base in order to preserve the user experience – keep the engaged base of users and communities – and hence value of TikTok. This would mean ByteDance would have to part with the algorithms and machine learning models, along with the historical usage data and pool of content in order to ensure a successful transition to the new buyer. Without this in place, TikTok would likely quickly lose its value after being sold (should it happen).

What could we expect in the coming days?

In the next 90 days (up to mid-November) we would likely hear more about how this potential deal develops, with information on viable suitors and deal structures coming to the forefront and also the rules of the game shifting, according to how Trump and the US government determines. And as many twists and turns that might come with the various parties and agendas along with the time urgency.

More pressure from US-China Trade War – clearly this is no longer just tensions, and not just limited to TikTok. Trump has issued an executive order to ban US business transactions for WeChat/ Tencent by 20 Sept, and the US government could take punitive action in the days to come against more Chinese companies, including Alibaba. Broadly we would likely see further similar actions being taken against various Chinese technology companies in the coming months.

In return, we could also see retaliation from the Chinese government on US technology companies operating in China. We might see specifically happening with Microsoft should they eventually go ahead to acquire the company. But this might depend on whether ByteDance is seen with sufficient strategic importance (similar to Huawei).

I’ll look to do another check-in on this topic at the right moment in the coming weeks. Hope this has been an interesting read!